Streamline your spending and cashflow ahead of next year’s peaks with B2B payment platform Pliant

The peak booking holiday period is a crucial time where businesses and travel agents can really get their year off to a fast start. But manual financial processes can be time-consuming and unreliable, which is frustrating to deal with when sales rise. For businesses, this can impact booking speeds, customer service and cashflow, while agents can face delays with reconciling payments, issuing card details and more.

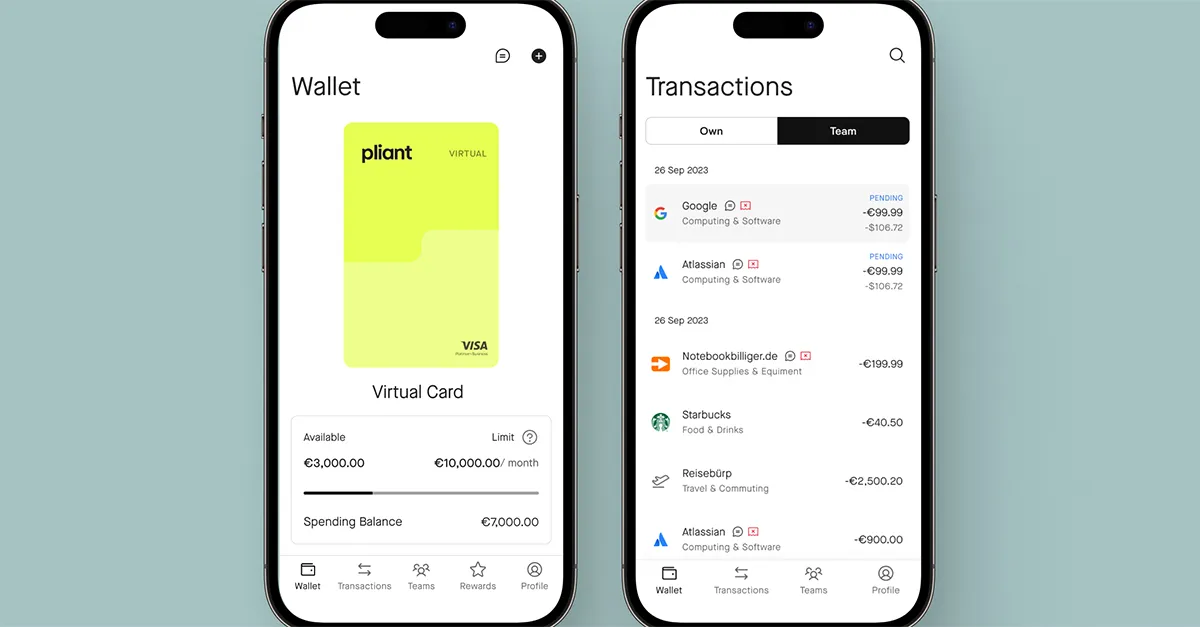

That’s where Pliant comes in. It’s a modern, easy-to-implement solution purpose-built for travel agencies – accessed via a web-based app or embedded into an agency system – which will ensure agents always stay competitive and responsive to clients. Its B2B payment platform and the Pliant Travel Purchasing Card ensure a simple and secure way to manage spending for travel companies.

Five ways Pliant makes a difference

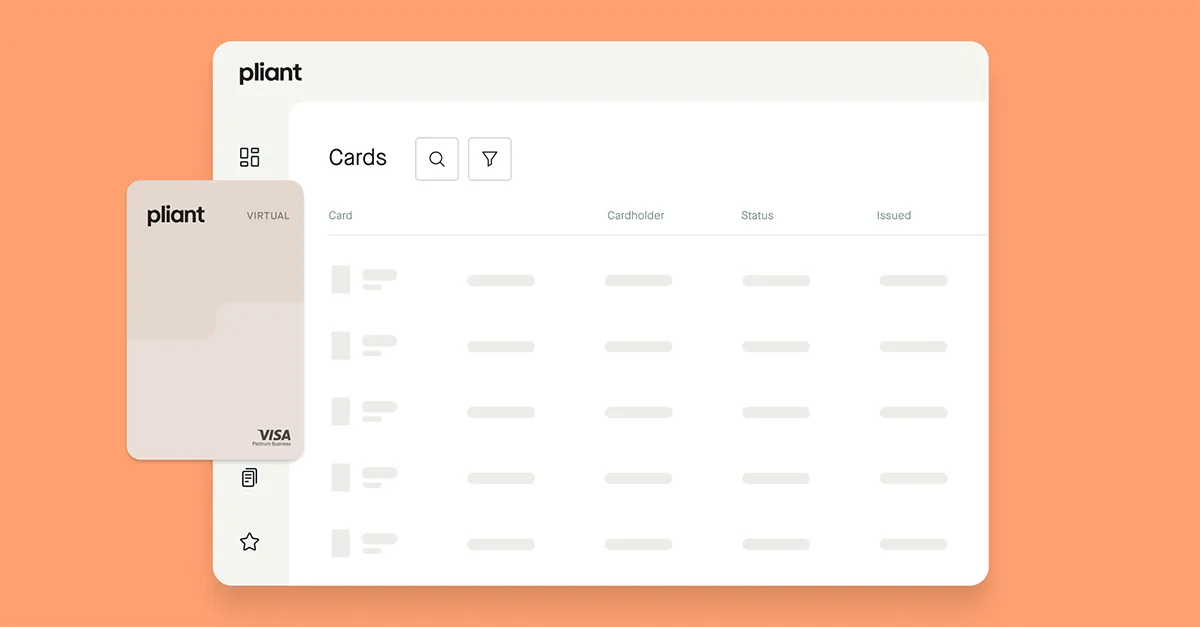

1) Cards can be issued instantly

Pliant’s intuitive application programming interface (API) – fully customisable for each company – allows the Pliant Travel Purchasing Card (TPC) to be issued straight away, whether digitally or in a physical format. The API also offers an easy way to tailor payment workflows with real-time reconciliation and custom reporting, which allows for smooth integration with the back-office systems that already exist.

2) Automated travel payments

The TPC is fully designed with the high-volume, complex payments travel agencies and companies often deal with, in mind. That’s why it can deliver fully automated payments and can be configured for secure transactions, while remaining exempt from 3D Secure transactions that have been known to bring about their own issues.

3) Maximise your money

Using Pliant brings plenty of unexpected benefits. With the TPC being a Visa card, that status helps companies unlock rebates, help cut costs and increase margins when paying suppliers. But it also helps with flexible currency options and the ability to open multi-currency accounts so businesses can be billed in the same currency as related transactions.

4) Real-time processing

Pliant ensures money management is made easy, with the option to track spending in real time and set custom card limits according to the requirements of your business. Each transaction that’s made is verified against the card limits and available credit, ensuring financial operations run smoothly.

5) The risk of fraud is minimised

For travel businesses, especially during peak booking season, every transaction counts. Pliant recognises that by implementing key authentication data such as VCAS Risk Score, Device IP address and Device IP Velocity, into the authorisation process. This helps reduce not only the risk of fraud, but the extra data gives issuers more detailed insights. This allows for fewer transaction declines due to missing information.

For more information and learn how Pliant can change your business, visit getpliant.com