You are viewing 1 of your 2 free articles

High jet fuel price premium ‘will ultimately hit airline ticket prices’

Airlines are having to pay a record premium for jet fuel, putting pressure on balance sheets and driving up fares for passengers.

Jet fuel was 50% higher than Brent crude oil at the start of this month, with airlines paying more than $140 a barrel for fuel even as global oil prices fell towards $90, according to Iata.

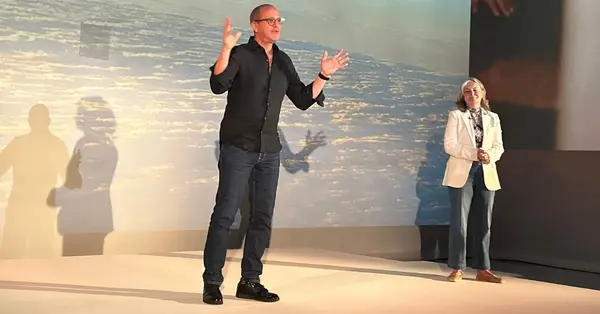

The airline trade body’s director general Willie Walsh told the Financial Times: “This is at levels I do not recall ever seeing before.

“We had expected this?spread to reduce as more jet fuel supply became available, but clearly the recovery in demand is stronger than the recovery in production of jet fuel.”

The price premium for jet fuel over crude oil averaged 17% between 2009 and 2019 but it had risen as high as 60% this year and “continued to put pressure on airline costs base”, Walsh said.

Russia was among the world’s largest exporters of oil “distillates”, which include diesel and kerosene jet fuel.

Europe was already a big distillate importer even before Russia’s invasion of Ukraine changed the dynamics of energy markets, while several refineries in Europe closed during the pandemic.

The resulting supply crunch and sharp rise in prices have put further pressure on airlines’ fragile balance sheets as fuel typically accounts for between 20% and 25% of their operating costs.

Walsh said the high cost of fuel “ultimately gets reflected in ticket prices”, echoing the sentiments of Ryanair chief executive Michael O’Leary, who has warned ticket prices are likely to rise for years.

Chloe Lemarie, an analyst at Jefferies, said airlines had responded to rising fuel prices by turning to newer and more fuel efficient aircraft, while keeping older jets in storage.

“This is a way in which airlines have been able to limit the fuel intensity of their operations,” she told the newspaper.

Some airlines also had more insurance against rising prices. Ryanair had hedged 80% of its expected fuel requirements until March 2023 at $65 a barrel before the Russian invasion of Ukraine, while rival Wizz Air had no hedges in place.

Ryanair shares have fallen 30% this year, while Wizz’s are down 55%.

However, Walsh said forward ticket bookings remained strong despite growing economic uncertainty, and that he felt the outlook for the industry was still “positive” as it emerged from the disruption caused by the pandemic.

“It is a challenging environment, but I think most airline management teams would be looking at the positives,” he said.