Lufthansa sets up task force to respond to any weakening in travel demand

Lufthansa Group has set up a task force to closely monitor current developments and respond quickly to any weakening in demand.

This could include adjusting capacity, the Germany airline group disclosed as it warned that “macroeconomic uncertainties, particularly the trade tensions between the US, the EU and other regions, are making it difficult to forecast the coming quarters accurately”.

Visibility for the third quarter “remains limited”.

However, the company said it also believes that potential market changes offer opportunities.

“For example, a further decline in kerosene prices could counteract temporary fluctuations in demand,” the group noted.

Despite the uncertainties, Lufthansa Group confirmed its forecast for the full year with an operating result “significantly above” 2024’s €1.6 billion.

The projection came as group reported that traditional first quarter losses had been trimmed by €127 million, resulting in a deficit of €722 million as revenue grew by 10% to €8.1 billion.

The group’s airlines expanded their capacity by almost 5% compared with the first quarter of the previous year. Load factors declined slightly to 78.7%.

Demand for air travel to and from North America remained strong in the first quarter, with passenger numbers up 7.1% year-on-year and an improved load factor.

“Currently, demand in the US sales region continues to rise. In March, Lufthansa Group airlines carried around 25% more passengers from the US to Europe than in the same month last year,” the group said.

“Global demand for air travel remains strong. The Lufthansa Group therefore expects another strong summer travel season overall.

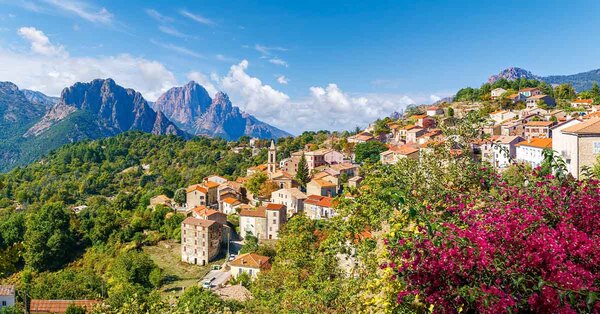

“The most popular vacation destinations are Mediterranean destinations, especially Spain, Italy, and Greece.

“Demand for long-haul travel also remains steady. This also applies to flights to and from North America, where ticket sales for the second quarter are up on the previous year.”

Chief financial officer Till Streichert said: “We are in a period of high volatility. In this environment, it is good news that we are making progress as planned on issues within our control, such as our turnaround programme at Lufthansa Airlines.

“At the same time, we are keeping an eye on market risks. We are well prepared to respond should these materialise.

“However, it is not just about risks, but also about positive factors that are already supporting our earnings performance today, such as favourable fuel prices and exchange rates. These can help to offset the financial effects of any changes in demand.

“Overall, we therefore remain confident that we will be able to achieve a full-year result significantly above the previous year’s level.”

Chief executive Carsten Spohr said: “Global demand for air travel continues to grow. Despite all the geopolitical uncertainties, we therefore remain on course for growth, are optimistic about the summer, and are sticking to our positive outlook for 2025.

“In the first quarter, our airlines were able to sell their expanded capacity at higher yields in the market. Our revenue improved by 10% compared with the previous year, with Lufthansa Cargo and Lufthansa Technik also contributing with their strong performance.

“On the North Atlantic, the number of guests rose by more than seven per cent in the first quarter, with higher load factors and better yields. Demand continues to be robust for the second quarter.

“I am pleased that our guests are benefiting from significantly improved punctuality and stability, particularly with our core brand Lufthansa. Operationally, we had our best start to the year in ten years.”