You are viewing 1 of your 2 free articles

Travel sector ‘becoming attractive’ to private equity after Covid recovery

The travel sector is becoming more attractive to private equity investment, according to Risk Capital Partners co-founder Luke Johnson.

Speaking at the annual conference of accountancy firm Xeinadin, formerly known as Elman Wall, leisure entrepreneur Johnson said: “The [travel] sector is going from being, probably for the last three years or so, what might be termed un-investable by investors, and un-lendable to banks, to becoming attractive.”

He added there were arguments to describe travel is the world’s largest industry, saying when it “gets it right” it can be “profitable and fun”.

Johnson said the industry had encountered “a very difficult period” but insisted “the signs are very promising the good times are back”.

He said: “I can’t pretend all private equity is interested in travel, but I did hear the other day that Goldman Sachs are looking to a travel deal, and I am encouraged.”

Johnson added that since Risk Capital Partners had made an investment in Simpson Travel earlier this year, there has been other activity around Martin Randall Travel and Newmarket Holidays as well as M&A rumours about Audley Travel.

He said: “I do think the sector is fair set compared to where it’s been in the last five years or so. I feel that it’s probably looking as strong as it will get.”

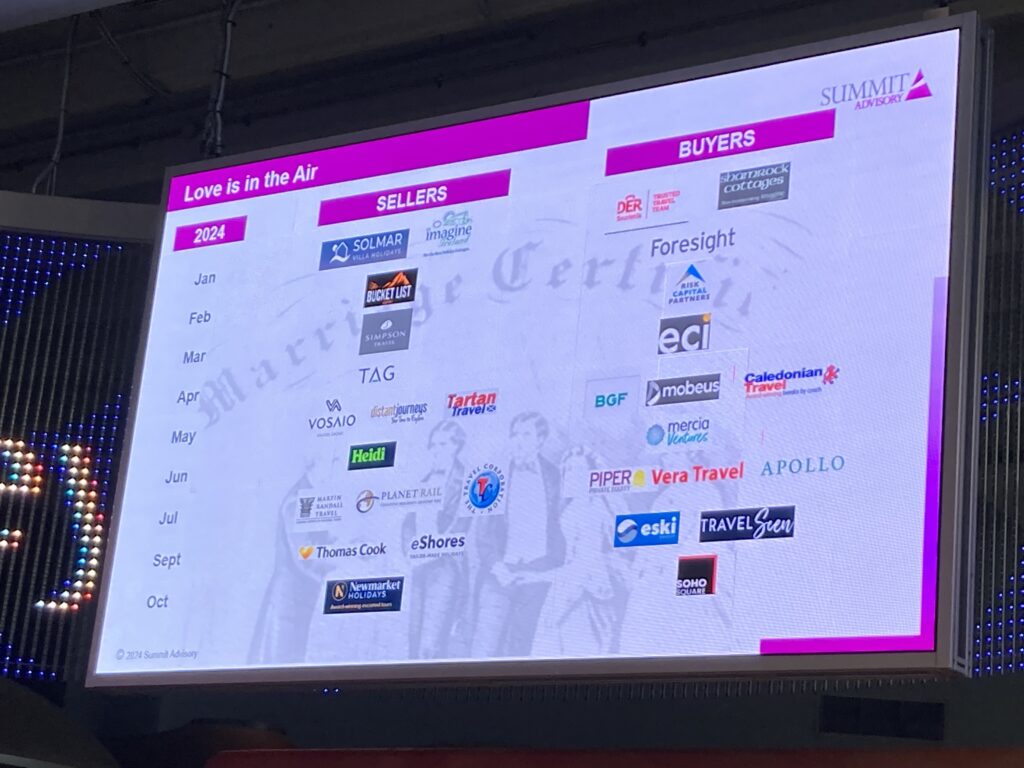

This resurgence in M&A for travel companies was also noted by Deborah Potts, Summit Advisory director, and Paul Whitney, Xeinadin’s head of corporate finance, who both observed a recent flurry of M&A activity among travel companies ahead of the Budget on October 30.

The comments also supported those made at Travel Weekly’s recent Future of Travel Conference last month and at Abta’s Travel Convention in Greece.

Potts said: “We’re very much hoping to be able to announce some new [deals] very soon. We have had a big return to travel already in 2024. We’ve seen far more activity than we’ve seen since Covid and private equity is very much returning to the marketplace.

“In fact, right now there’s a real rush to get businesses to the altar and tie the knot before the Chancellor’s Budget on October 30, which is just two weeks away, so it’s very crazy at the moment and we’ve never been busier.”

Potts noted the sale of business travel specialist Blue Cube Travel to Talma Travel Solutions this week as the latest example of interest.

And while Whitney said there was “probably a little bit too much to do” to deliver more activity before the Budget, he was hoping to “supercharge the number of transactions” the firm could deliver in the travel sector.

Travel M&A timeline 2024.