You are viewing 2 of your 2 free articles

Financial facts show Ryanair should enter package business now

Steve Endacott further outlines his case for carrier’s acquisition of OTAs

After my last blog on this topic, I was told by some senior industry players that I was “delusional” and writing like a “clickbait” journalist.

In this blog, I’ll attempt to adopt the style of a Financial Times reporter, concentrating solely on the financial statistics that support my argument for Ryanair to acquire both On the Beach (OTB) and Loveholidays.

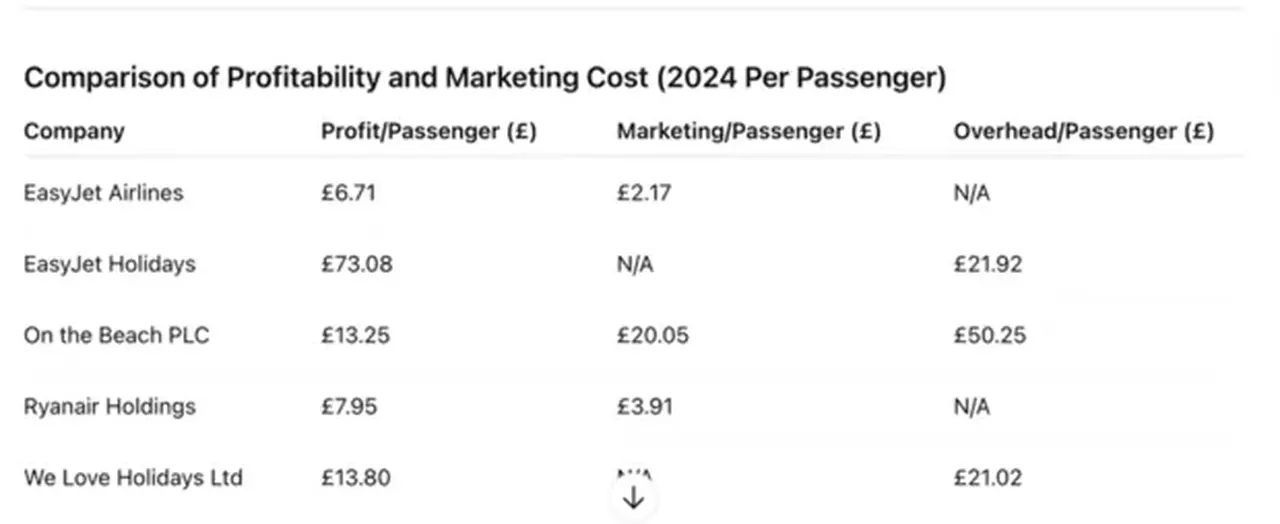

However, to do so, I will need to use easyJet holidays as my baseline for comparison, as it shows why the City is so eager for its rapid expansion, given easyJet earns a profit of £13.42 per return flight while a holiday passenger generates a significant £73.08 per passenger. Put simply, a holiday customer is five times more valuable than a seat-only customer (see below).

When considering easyJet holidays’ profitability or its share of the parent company’s total flight capacity, it is essential to remember that the airline counts customers based on sectors flown. For example, a return trip to Majorca counts as two passengers, whereas the holiday division counts it as one customer. Therefore, in 2024, the holiday division with 2.6 million passengers used 5.2 million flights, accounting for 5.1% of the airline’s total 100.4 million seats.

However, it contributed £190m or 31% of the group’s £610m profit. It does not take a City genius to realise that easyJet has a fast route to increase group profits by rapidly scaling its holiday division at 25% per year.

As the table below shows, easyJet has a much higher profit per passenger than OTA rivals On the Beach (OTB) and Loveholidays, which can only deliver £13.80 and £13.25 per passenger profits.

Although these OTAs face high API fees from easyJet, unlike easyJet holidays, this has little effect on overall profitability since their primary seat supply comes from API fee-free sources such as Ryanair and their Turkish airline partners.

Similarly, it is unlikely that easyJet holidays will have an advantage in hotel purchasing. Like its OTA rivals, it has avoided extensive hotel guarantees and has a shorter trading history than On the Beach, whose buying team has over 20 years of experience in the dynamic packaging sector and which shifted en masse to On the Beach after the collapse of bed bank player On Holiday Group.

The relative size of the businesses of On the Beach and easyJet holidays is similar, but the rapidly expanding easyJet holidays and the larger-scale Loveholidays both have lower administrative overheads than the more mature On the Beach.

The key differentiator is that easyJet holidays has few marketing costs, as most of its traffic comes from its parent company’s flight-only website. EasyJet, as a travel ‘super brand’, has substantial direct brand traffic and, unlike its OTA competitors, is not reliant on costly Google travel search traffic at the destination, resort or hotel level.

This gives it a dramatically lower cost of customer acquisition compared with its OTA rivals, and it is the ever-increasing cost of Google traffic that is strangling the profitability of OTAs and causing their capitalisation to be heavily discounted despite their current healthy profits.

Ryanair also owns calculators and, as a publicly quoted business, will have financial analysts asking, “Why are you not in the profitable holiday sector?”

In my opinion, the decision to move into the sector is a ‘no-brainer’ because, like easyJet, Ryanair could generate free traffic for its tour operating division. For instance, if it acquired On the Beach, it would immediately increase profits by eliminating its £20 advertising costs and expanding its scale to reduce overheads, bringing it in line with its competitor, Loveholidays. This could add a further £30, resulting in a potential profit boost of £50 to £63.25.

Loveholidays’ accounts, as a private business, are less straightforward to analyse, but why shouldn’t it also see a £50 increase in profits to £63.80, considering these are still a full £10 behind easyJet holidays’? Applying this £50 boost to the combined 7 million passengers carried by the two OTAs would generate an extra £350 million in their bottom lines, representing a substantial shift in their existing combined profitability from £94 million to £444 million.

Therefore, even if Ryanair paid £1 billion, which is a P/E of 11, for the businesses at their current profitability, the increase in profits it could generate would result in a payback period of 2.25 years, representing an excellent return on investment for any business.

Now, obviously, some key objections have been raised against this argument, so let’s examine these one at a time.

‘Ryanair never buys and prefers organic growth’

As the dominant low-cost carrier with a very clear model, why would Ryanair acquire another airline apart from access to slots or source market dominance? Hence, I agree it has so far preferred organic growth in its core flight market.

However, it lacks expertise in the holiday sector, as well as the necessary technology, and has a customer service ethos that few passengers would trust with their holidays. Partnering with trusted travel brands that have customer service commitments dictated by Atol bonding regulations, which would eliminate any Ryanair customer service issues, makes a lot of sense.

Lastly, as all financial analysts will point out, accounting rules allow the entire £1 billion acquisition cost to be recognised on the balance sheet. Even with an aggressive 10-year goodwill depreciation costing £100m per year, the net boost to Ryanair group’s profits would be £344m annually. Not to be sniffed at!

‘Competitors would refuse to supply seats to the OTAs’

EasyJet and Jet2 are already the OTAs’ competitors and supply less than 25% of seats combined due to high API fees and restricted seat access, with Ryanair, long-haul scheduled airlines and core Turkish airline partnerships providing the balance.

In reality, just as when I headed Airtours and traded distribution through my retail outlets with competitors, the same will likely happen again, and why would easyJet truly benefit from cutting these high-margin API flight sales via these OTAs?

The Competition and Markets Authority (CMA)

Again, this is a possibility but unlikely given the size of Tui Holidays and the rapidly expanding easyJet holidays, which would mean the new travel division would have less than 50% market share.

Conclusion

With the approaching disruption that the move to AI search will have on the dominance that Loveholidays and On the Beach have over Google pay-per-click click traffic, the ability for management teams to ‘dock’ their business in a safe ‘harbour’ where they are guaranteed a significant element of free spin-off traffic from the Ryanair website should be attractive, however, even I would hesitate to join Ryanair, unless I was guaranteed a degree of independence that they are unlikely to get.

From an investor’s point of view, it’s also a ‘no-brainer’ as Loveholidays is owned by venture capital funds which are still involved long after their standard investment term and On the Beach as a quoted company is vulnerable to anybody offering a 20% premium over the low current share price.

In my opinion, maths doesn’t lie, and this is why I have spelt them out in such detail in this blog. The only unknown is how easyJet and Jet2 would react to a Ryanair move, as the last time the UK market consolidated with the merger of Thomson and First Choice, further consolidation followed rapidly.

I personally believe market consolidation is inevitable, with Ryanair being the obvious buyer, but I’d love to hear your opinions. Am I still promoting a ‘flight of fantasy’ or a logical argument? If you spot any errors in my amateur financial analysis, tell me – but remember this is a big picture issue.