You are viewing 1 of your 2 free articles

MPs issue damning report into collapse of Thomas Cook

Business secretary Andrea Leadsom and her department have been accused by MPs of showing “an extraordinary lack of interest” ahead of the collapse of Thomas Cook.

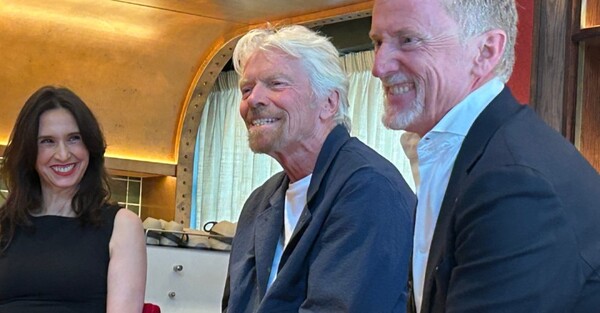

The parliamentary committee leading an inquiry into the failure of the travel giant also issued a damning verdict of mismanagement by successive bosses – Peter Fankhauser, Harriet Green and Manny Fontenla-Novoa – who all appeared to give evidence last month.

The committee also voiced “disappointment” that the government failed to press ahead with audit reforms ahead of the failure of Thomas Cook which led to 9,000 UK job losses.

Video: Ex-Thomas Cook bosses face select committee

The Business, Energy and Industrial Strategy Committee put forward a series of recommendations on corporate governance, executive pay and bonuses after hearing evidence from the former Thomas Cook executives while examining the failure of the company.

Committee chairwoman Rachel Reeves said: “Our inquiry has been cut short by the election but it’s clear that a series of misjudgements at Thomas Cook led to its collapse.

“The piling up of debt, confused business plans, lack of challenge in the board room and by auditors, and aggressive accounting practices all contributed to the failure of the business.

“During our inquiry, we’ve witnessed buck-passing and blame-shifting but precious little humility or reflection from those at the top of the business.

“Directors and senior management pocketed hefty sums in annual salaries and bonuses that Thomas Cook staff will only have dreamed of earning throughout their entire careers.

“Mr Fankhauser told us he would reflect on the huge salaries he has earned. Given the riches which Thomas Cook poured into his pockets I hope that Mr Fankhauser will realise that now is the time to put right the wrong he has done.

“Manny Fontenla-Novoa offered apologies but appeared unable to identify any single thing he would have done differently during his time stacking up debt at Thomas Cook.

“The circumstances of Harriet Green’s departure remain unclear but her vision of the business would likely have seen fewer stores and fewer staff. We will never know whether it might have rescued the business.”

Reeves added: “There was a lack of challenge in the boardroom as the company piled up debt and Thomas Cook management missed opportunities to reduce debt levels and give the business a viable future.

“Huge financing costs hamstrung attempts to invest in the business. The final collapse of the business resulted in misery and uncertainty for staff and customers, and brought a significant hit to the taxpayer.

“The failure at Thomas Cook has been also been notable for the extraordinary lack of interest shown by the Business Department and its secretary of state in the days and weeks leading up to the collapse.

“It is also a matter of fact that many of the necessary measures on audit, on executive pay, and on corporate governance have been sitting in the government’s in-tray for months.

The CMA [Competition and Markets Authority] and BEIS committee published proposals in April on reforming the audit market, on tackling conflicts of interest, and on improving audit quality but the government failed to bring forward the legislation necessary to drive this forward.

“A new government needs to put this right and ensure the Queen’s Speech in a new Parliament includes the laws needed to make this a reality.”

The committee’s report found that of the executive directors who gave evidence, Green was the only one to acknowledge significant challenge from the rest of the board.

“Green further raised concerns about the board’s lack of cognitive diversity, suggesting that the board had not sufficiently understood ‘how to change business models’.

“It is notable that she was asked to leave Thomas Cook in 2014 so that the group could “return to more traditional travel-oriented leadership”, despite her success in raising the company’s share price from 16p to 136p,” the committee said.

“It is not possible to prove causality between lack of diversity on the Thomas Cook board and the collapse of the company.

“Nonetheless it appears that the board was insufficiently challenging of repeated decisions to take on very substantial debts, and that there was significant resistance to following-through on new business approaches.”

Leadsom told the committee in a letter responding to questions raised that Thomas Cook’s financial problems were “substantial, long-standing and well documented”.

Government financial assistance would not have resolved them, as highlighted by the example of Air Berlin which collapsed in 2017, she added.

“The German government provided a temporary €150 million bridging loan to allow it to keep flying through the summer; the airline was still wound down within a matter of months,” Leadsom said.

She said that the first port of call for a business facing cashflow issues should be commercial lending, for which UK banks are well capitalised.

“Thomas Cook’s financial problems are well documented. Unfortunately, in a competitive market, some businesses do fail and it is not the government’s role to prop up companies,” added Leadsom.

She claimed that a rescue deal involving £200 million to enable Thomas Cook to weather the winter season would have been “a poor decision for the taxpayer”.

There were “serious risks to taxpayers’ money were government to have intervened.

Leadsom said: “I believe this would have led us to exactly the position we are in today – of repatriating tens of thousands of people, yet having spent up to £250 million of taxpayers’ money trying to keep the company afloat.

“Given the financial position of the group, a rescue deal would have been a very poor decision for the taxpayer.”

Leadsom revealed that the cost of repatriating Thomas Cook holidaymakers is expected to be double the £40 million bill of a similar but smaller operation following the Monarch failure in 2017, with the majority of costs covered by the Atol scheme.

The Official Receiver’s costs for the first three weeks of the liquidation amounted to about £21 million.

“As the liquidation is on-going, the costs will rise; we will only be able to provide a total, substantiated figure once the process is concluded,” Leadsom warned.

Hays Travel revealed that it paid £6.1 million for a licence to occupy 555 former Thomas Cook agency branches for a period of nine months with an option to extend for a further three months.

This payment reflected the “significant losses” made in 93 shops within the portfolio and the potential liability for the condition of some of the properties, the independent agency chain revealed in a letter to the Business, Energy and Industrial Strategy committee.

“According to the information provided by the liquidator 93 shops were generating total losses of £5 million pre-failure.

“However the remaining shops were contributing a £28.8 million profit, so the starting net position is a £23.8 million profit per annum.”

There are 49 duplicate shops in towns and cities where Hays Travel currently operates – less than 10% of the total estate of 555.

Hays Travel said it is not possible to say at this stage how many shops will have to close.

“It is the intention to trade in all the shops – where we are able – during the licence period. This will give the company the opportunity to look at how each shop is performing and whether there will be a need for a closure.

“In some places Hays Travel already operates successfully with two or more shops. This is dependent on the proximity.

“In relation to job losses Hays Travel is constantly recruiting and always needs a pool of staff to cover holidays, sickness absence and maternity leave.

“There is no intention to make staff redundant should a decision be taken to close a shop after the licence period has elapsed.”