You are viewing 1 of your 2 free articles

Nearly a fifth plan to spend more on holidays this year, says report

Nearly one in five consumers in the UK plan to spend more on holidays this year, according to a report by NatWest.

Research into the spending habits of 2,000 people has suggested that holidays are increasingly being considered a ‘necessity’, rather than a ‘luxury’.

NatWest’s Retail and Leisure Outlook Report 2024 found that 17.3% of UK consumers plan to spend more on holidays this year compared with last year. Even among those expecting their finances to weaken in 2024, a third (33.5%) plan to increase holiday spending.

David Scott, the bank’s head of consumer industries, said: “The travel industry will be heartened to hear that a fifth of consumers are planning to increase their holiday spending this year. This shows just how much Britons value travel and exploration, even at times of high financial pressure.”

The research suggested that nearly half of consumers (44%) expect to have weaker finances this year compared with 2023.

But among that bracket, only a quarter (27.1%) expect to reduce their holiday spend this year.

Members of Gen Z and Millennials are under more pressure than those over 60 to cut back on holiday spending, according to the research.

Approaches to saving money might include taking shorter trips, opting for shorter flights or taking a domestic trip than going abroad.

The report also found that consumers consider dynamic pricing to be more acceptable for hotels and airline fares than for any other spending category.

Retail Economics carried out modelling and analysis for the report.

Richard Lim, the consultancy’s chief executive, said: “Holidays have become a critical, almost non-negotiable area of spending for households.

“Most consumers are determined to get away this year, particularly as they look to ‘catch up’ on travel after holiday plans were derailed during the pandemic.

“Consumers are now unwilling to cut out holidays even as personal finances come under pressure from heightened interest rates. Instead, households are becoming savvy by embracing off-peak travel, turning to cheaper short-haul destinations and looking out for last-minute deals.

“But squeezed budgets will mean households inevitably have to cut back elsewhere.

“This includes spending on home categories being a lower priority compared to holidays and essentials, as elevated borrowing costs widen the scope of households under pressure, particularly among those who recently renewed mortgages or rental contracts.”

The report is based on a survey undertaken in December 2023 and it also draws on third-party sources including national statistics.

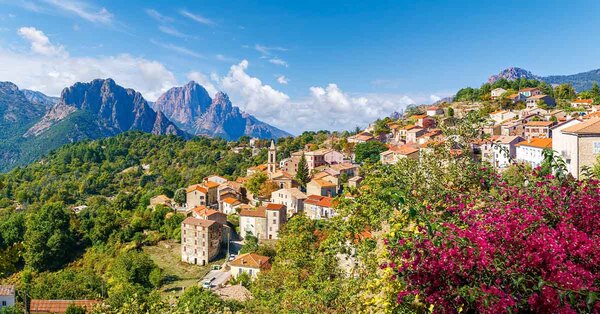

Picture: Lance Asper/Unsplash