You are viewing 1 of your 2 free articles

Aviation sector criticises further rises in APD from 2027

The aviation sector has criticised government plans to increase the rate of Air Passenger Duty (APD) again in 2027, following the rise which is already due in April 2026.

Details of the increases were confirmed as part of the Budget announced by Chancellor Rachel Reeves on Wednesday afternoon (November 26).

EasyJet chief executive Kenton Jarvis said on Tuesday he was hoping for a freeze on the tax, but "wasn’t optimistic" it would happen.

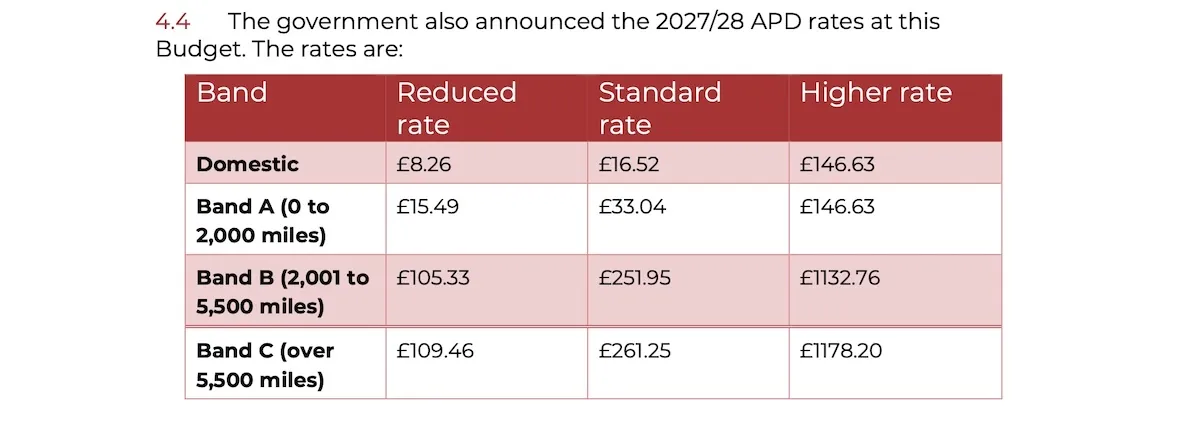

The industry already knew APD will rise from £13 to £15 on short-haul economy fares from next April, with larger increases on long-haul and premium rates.

Now, the rate will increase at the rate of inflation from April 2027, along with the expansion of the higher rate to cover all private jets over 5.7 tonnes.

The government confirmed it will “uprate all rates of Air Passenger Duty in line with RPI [retail price inflation] from 1 April 2027”.

The economy rate of APD on short-haul international flights will increase from £15 to £15.49 from 2027.

The premium short-haul rate will rise by £4 to £32 in 2026 and to £33.04 in 2027. Long-haul rates will rise to £102 and £106 in economy depending on the distance next year, with those figures rising to £105.33 and £109.46 in 2027.

Long-haul rates for premium economy will rise from £244 for flights up to 5,500 miles and £253 for those over to £251.95 and £261.25 respectively.

Those paying the higher rate of APD will be charged £142 for short-haul and £1,097 and £1,141 for the two long-haul bands from next April, with those fees rising in 2027 to £146.63, £1,132.76 and £1,178.20.

The British Airline Pilots Association (Balpa) said that it “condemned” the Budget as “bad news for the aviation industry”.

Alice Sorby, Balpa director for strategy and reform, said: “This Budget is bad news and more bad news for the aviation industry.

“Firstly, the chancellor has ignored calls from Balpa…and the industry and announced plans to increase Air Passenger Duty in line with RPI from April 2027.

“Bad news for passengers, especially families going on holiday, who now face increased ticket prices.”

Sorby also said the Budget had “even more bad news” for people considering a career as a pilot as there were no measures to make “eye-watering” training costs more affordable.

Dan Owens, chief executive at Belfast International Airport, said: “For a Chancellor and government that talks about growth, today’s Budget will likely damage the UK’s tourism and aviation sector with its increase in Air Passenger Duty.

“As an island off an island, Northern Ireland needs air travel, as we do not have the option of rail connectivity that the rest of the UK has.

“This is an additional tax on air travel that the Irish Republic does not have and therefore it makes Northern Ireland less attractive to airlines considering introducing new routes. This is a harmful tax that suffocates economic growth.

“The failure of the UK government to act means we will now ask the NI Executive to step in.

“If the Executive is committed to meeting its target of increasing the value of tourism in Northern Ireland to £2 billion by 2030, then it needs to look at reducing APD as it is a proven way to deliver greater international connectivity and economic growth.”

Clive Wratten, chief executive at Business Travel Association, said: “This Budget confirms a series of new costs for those who travel for work – costs that risk undermining growth at the very moment the UK economy needs it most.

“The uprating of standard Air Passenger Duty is frankly huge. £4.195 billion was collected in 2024-5 and adding another 3.6% to that will add further pressure to everyday business travellers.

“APD is not simply a passenger charge; it is a tax on global connectivity.

“Consider an economy-class flight to a trade partner like India – a route used frequently by junior engineers, researchers and technical specialists. The APD on that ticket will be £102 per passenger from 2027, before a single penny is spent on accommodation or visas.

“This is not a cost borne by executives in business class; it is a cost borne by the frontline workers who deliver the very trade relationships the UK is trying to strengthen.”

Wratten also noted concern about the pay-per-mile levy on electric vehicles and mayors being given the power to introduce an overnight visitor levy, which will both further increase the cost of travelling for work.

Airports association Airports UK criticised plans to double business rates on larger premises, which it said would force some of its members to reconsider investment and could put “thousands of jobs at risk”.

It said: “The chancellor has staked the UK’s growth on airports, and while the changes to transitional relief are very welcome, a doubling of their business rates could still force some to review billions of pounds of transformational investments across the UK and potentially puts thousands of jobs at risk in the longer-term.

“This will obviously have a knock-on effect for the businesses that depend on airport connectivity in all areas of England, negatively impacting local economies that depend on the supply chains, tourists and connections their airports provide.

“It’s a short-sighted move that passengers will feel in their pockets with both hard-working families and business flyers experiencing price rises and more limited choices.”

Airlines UK chief executive Tim Alderslade said: “Any rise in aviation or other taxes impacts passengers and freight and so the Government needs to ensure that the UK aviation industry is internationally competitive so it is able to support the country’s economic growth.”