UK consumers are increasingly interested in spreading out payments for travel. YouGov’s Eva Satkute Stewart looks at the data

When countries lift restrictions on travel, prospective travellers may be looking for more ways to pay for – and afford – their holiday plans.

In order to help consumers pay for travel, several online travel agencies and airlines offer flexible payment options for travel purchases through Affirm, PayPal, Uplift or their own version of a ‘buy now, pay later’ plan.

These types of solutions offer travellers the ability to spread the price of big-ticket purchases such as a hotel stay or an airline booking over a period rather than pay the entire sum at once.

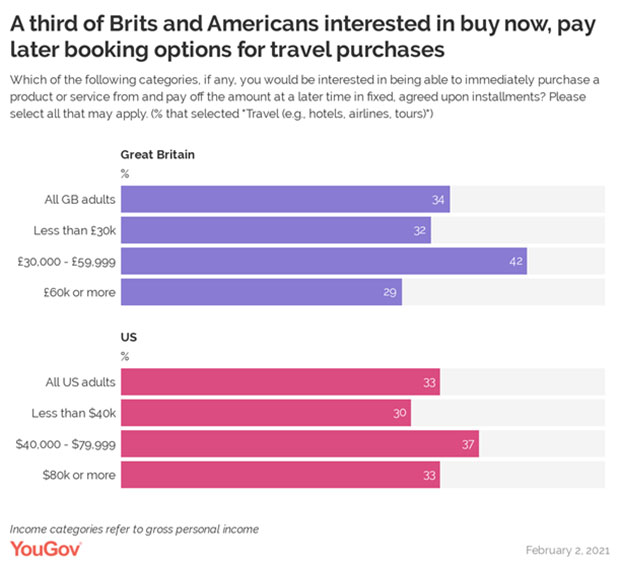

A new YouGov snap poll in Britain revealed 34% of respondents would be interested in being able to purchase a travel service and pay it off over time.

Middle-income respondents earning £30,000-£59,000 a year expressed the highest rate of interest in buy now, pay later payment options in the travel category (42%).

Pent-up travel demand in the UK has many thinking and dreaming of travel. The latest data from YouGov’s Global Travel Profiles shows 47% of UK adults say they plan to go on a domestic holiday some time in 2021, with 33% planning an international trip as well this year.

A similar YouGov snap poll in the US found one third of Americans would be interested in spreading out the cost of their travel purchases over time. And as in Britain, middle-income Americans appear more likely to express interest in paying off travel purchases in instalments.

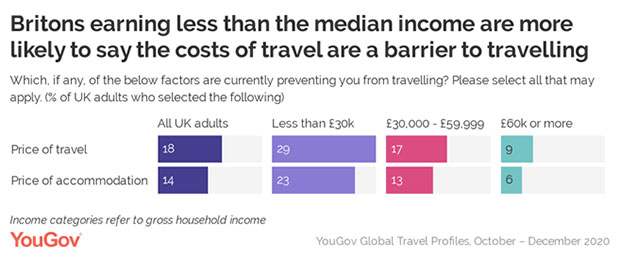

A broader look at barriers to travel reveals significant proportions of Brits (18%) and Americans (27%) view the price for travel as an obstacle preventing them from travelling, only behind barriers such as travel restrictions and health risks.

In the UK, another 14% also said the price of accommodations stops them being able to travel.

There are significant differences by income, with those earning less than the median income more likely to point to costs of travel (29%) and accommodation (23%) as preventing them from travelling.

Few people with an annual household income of £60,000 or more cite the price of travel and accommodation as barriers to travel.

For some travellers, financing a holiday can be a great choice if they have a holiday in mind and the means to pay for it at a later time.

Many types of buy now, pay later solutions have a zero-interest fee policy and provide a way to pay for holidays.

Methodology: The snap polls are based on interviews of 1,200 GB adults and 1,926 US adults. All interviews were conducted online on February 2, 2020. Results in the US have been weighted to be nationally representative. In the UK, results are weighted for age and gender.