Sector well-placed to benefit from consumer trends, say Henry Wells and Mark Stoddart of Duff & Phelps

Over the next two weeks, Henry Wells and Mark Stoddart from the M&A advisory team at Duff & Phelps will overview private equity investment in European travel businesses and what the future for this may hold.

Questions we often receive include: “Why are private equity investors so interested in the travel sector?”, “Is this a particularly new phenomenon?”, and “Will it continue?” Over the last 20 years, the travel sector has changed beyond all recognition, while at the same time not changing much at all. Consumers still want a “deal”, whether it is luxury or more basic, and it is all still about hotels, flights and experiences. What has changed is choice, distribution and social media. The four biggest travel businesses are now the big two and quality can be heard via the internet, with barriers to entry being dismantled and smaller players being able to build scale quickly and distribute efficiently.

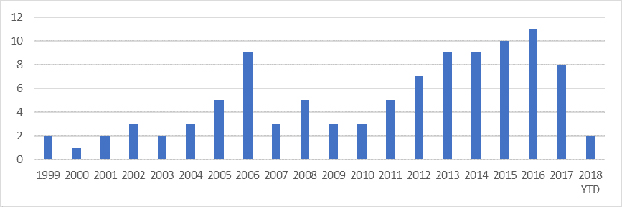

As both the sector and consumers evolved through the early 2000s, private equity’s interest in the sector grew. Attracted by disruptive online players with asset-light, scalable models and attractive cash flow dynamics, the number of private equity-backed deals in the UK grew through the early 2000s, supported by significant cheap credit and growing consumer wealth. The chart below looks at the number of deals where private equity has been an acquirer of UK and Eire travel businesses since 1999.

Not surprisingly, the global financial crisis impacted the number of deals as credit became tougher and consumer spending pulled back. Despite this, the sector remained resilient (highlighting consumers’ appetite for travel) and investment remained possible, particularly for specialist and niche operators that had either established a market-leading position or were disrupting a segment of the industry. Since 2012, interest and activity has returned, supported by improving market dynamics, significant available capital and a growing number of high quality businesses seeking investment.

To a large extent, travel’s popularity with private equity continues because it is a “tech-enabled” sector where consumer behaviour is constantly changing. Just as the first online travel agents helped disrupt the market, innovation continues to offer opportunities for new entrants and rapid growth. We see the increasing importance of mobile apps, social engagement and AI as consumer sophistication continues to evolve. Predominantly online businesses are constantly required to improve systems; be it their booking engine, more intelligent analytics, improved automation or better personalisation (human or machine); and offline businesses are using technology in increasingly innovative ways to market to customers. Change provides opportunity.

Travel is only one of many consumer-facing sectors that private equity invests in (retail, pubs and restaurants, and health and fitness have all been popular investment areas). However, travel is arguably more attractive at present, as it is well-placed to benefit from consumers’ preference for experiences over ‘things’ and holidays are, for now, high on consumers priority lists.

Private equity now has over a decade of experience in the sector and understands many of its characteristics, its foibles and its opportunities – and more importantly, success breeds confidence; those with experience keep coming back for more and other investors want some of this success.

With growing experience in travel and good connections in other sectors, particularly technology, private equity can increasingly bring expertise and support to their travel investments, in addition to financial support.

Travel remains a sector where a business with an idea worth shouting about can grow rapidly and, perhaps become a market leader.

Next week, we will look at some of the future trends of private equity investment in travel.