Helen Roberts, UK head of travel and hospitality at GfK, assesses what industry data is telling us about the current market

The events impacting British travellers at the moment are well-documented. Terrorism, Brexit, the Zika virus, even the delays at Dover have added to the ‘holiday re-think’.

Each has a potential to impact how and where people holiday in different ways, but where there are challenges for the industry, so too are there opportunities. Here’s how we see it, using our latest bookings data and consumer research.

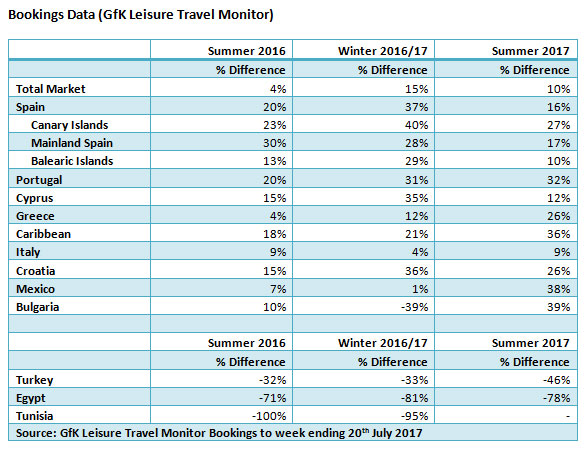

Overseas travel: Spain and Portugal benefit at the expense of Turkey, Egypt and Tunisia

The volatile environment hasn’t curbed appetite to travel. Overall, our research points to an increase in future travel plans: 39% of people who travel for leisure intend to travel more in the coming year.

This is reflected in the increase in bookings seen for both domestic and international travel.

According to the latest GfK Travel Monitor data, outbound bookings for Summer 2016 are currently up 4% year-on-year. Similar figures from VisitEngland corroborate this: 40% of accommodation providers are reporting increased visitor numbers.

Bookings for Winter 2016/17 and Summer 2017 are also both up dramatically on last year’s equivalent, suggesting earlier bookings.

The main difference, though, is in the mix of destinations that have benefitted from this increase in bookings. Spain and Portugal in particular are showing growth at the expense of Turkey, Egypt and Tunisia.

Safety and security are an increasing concern for a third of travellers, especially for young families. Rather than reduce bookings, travellers are choosing where they go more carefully.

The selection of travel company, airline and route choice are also being impacted as travellers do more research with safety and security in particular in mind. In other words, the traveller’s path to purchase is changing and the industry must respond.

The international opportunity

Travellers who have consistently visited the same destination or resort are looking at other options, and require different information and inspiration to help them make their purchase.

They may draw on a wider set of review and advice sources – right up to the departure day. Supporting travellers through this process is an opportunity to increase bookings and improve the customer experience.

Brand trust and confidence are key to growth. Providing travellers with peace of mind by enabling them to change their holiday plans in response to an incidence could lead to growth in the package and cruise markets.

All-inclusive and the cruise markets could also help holidaymakers mitigate the impact of exchange rate fluctuations. Operators need to adapt these offers to reflect today’s consumer trend for personalisation by tailoring packages, ideally within an inclusive package.

The UK opportunity

The fallout from Brexit is evident. People are concerned about holiday prices and spending money. In fact, 10% of people are now more likely to consider all-inclusive holidays.

More of those aged 25-44 and those on higher incomes are likely to do this, suggesting an opportunity for those operators offering higher-end, family all-inclusive holidays and cruises.

Perhaps a combination of all these elements has led to 19% of people in the UK saying that they are now more likely

The weakening pound also makes the UK cheaper for inbound tourists, providing a further clear opportunity for growth. According to recent data from ForwardKeys, there has already been a 4% increase in inbound flight bookings to the UK since the Brexit vote

There’s clearly opportunity for growth in the domestic market. Offering high quality and a variety of destinations and diverse experiences will encourage the considerers to stay in the UK, either for their main holiday or short breaks.

Making the UK a destination of choice, rather than fallback option, will be key to sustaining that growth opportunity in years to come.

Whatever the wider economic and political situation, people still want to travel – just where and how is changing. Listen to changing consumer sentiment and respond.

It is key to provide brand trust and to help your customers. Whether that means providing them with guarantees of assistance, other options in response to man-made or natural incidents, more information and inspiration at the time of booking, or offering them the right kind of all-inclusive holidays or flexible holidaying with fixed prices, there are many opportunities.

The range of destinations that the UK has to offer and that can be developed is considerable – from spa breaks and luxury hotels to activity/learning experiences and cultural events – the list is almost endless.

And when the receptive audience is younger and more affluent, there is considerable scope for inspiring them to take UK holidays and short breaks. The time to maximize these opportunities is now.