Thomas Cook has defended its £750 million rescue plan against a claim that the debt for equity swap could be blocked by bondholders.

The reported accusation was made by Citigroup analyst James Ainley who calculated that Thomas Cook shares would be worth just 3p under the plan.

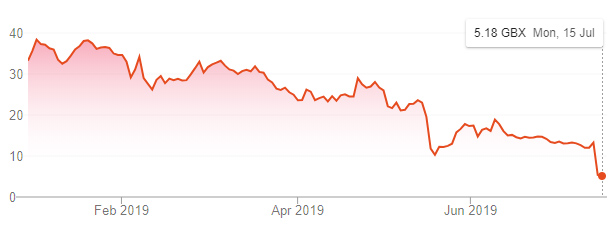

Thomas Cook shares fell another 4% yesterday to 5.2p as the market awaited details of the proposed debt for equity swap before rising to 5.3p and falling back again this morning.

Thomas Cook share price, year to date, via Google

The shares have slumped by more than 60% since it revealed being in “advanced discussions” with largest shareholder Fosun about the deal that would see the Chinese group take a majority stake in Thomas Cook’s holidays unit and a minority in its airline. Fosun has an 18% stake in Thomas Cook.

Meanwhile, banks and bondholders will take a majority stake in the company’s airline and a minority stake in the tour operator unit.

But Ainley was reported by the Daily Telegraph as saying: “The uncertainties are significant and the risk of the process stalling seems high.”

He added that for the scheme to be a success, Thomas Cook management needed a “strong turnaround plan, about which little detail has yet been given”.

Podcast: What next for Thomas Cook?

Chief executive Peter Fankhauser admitted the rescue deal is “not the outcome any of us wanted for our shareholders” and that it “comes at the cost of a significant dilution”.

However, sources close to Thomas Cook said that bondholders had a vested interest in backing the deal, otherwise they risk being wiped out if a rescue plan cannot be agreed, the newspaper reported.

A Thomas Cook spokesman said: “The board is clear in its view that it is in the best interests of all the group’s stakeholders, including bondholders, to pursue a full recapitalisation supported by new investment into the business.

“It is a pragmatic and responsible solution which provides the means to secure the future of Thomas Cook.”

More: Chinese group would retain Thomas Cook name [June 19]

Comment: What now for Thomas Cook? [July 5]

Comment: Can Thomas Cook survive? [May 19]