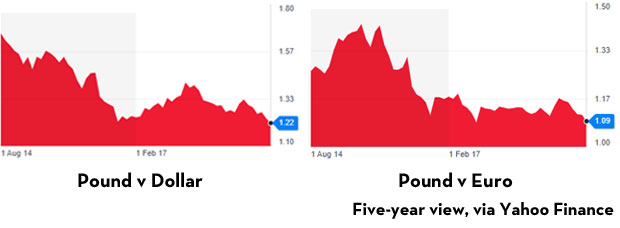

People heading abroad on summer holidays this week face a foreign currency squeeze as the pound slumped to its lowest level for more than two years.

Sterling fell by as much as 1.3% against the dollar to $1.2230 and €1.1004 in reaction to new prime minister Boris Johnson’s headline no deal Brexit stance.

And there are fears that the value of the pound could drop further to as low as $1.18 and €1.05.

The last low for sterling was $1.2049, reached in January 2017.

The pound was trading at $1.50 against the dollar before the EU referendum in June 2016.

Nigel Green, founder and CEO of deVere Group, an independent financial advisory organisation, warned: “Brexit has been a hammer-blow to the pound and this has been exacerbated by Boris Johnson becoming prime minister.

“As such, demand for solutions to the weak pound is set to soar by UK travellers and British expats over the summer as sentiment towards sterling remains dismal due to an increasing probability of a Boris-driven no-deal Brexit.

“While much of the impact of no-deal will have been priced-in, it’s clear that holidaymakers do need to seek alternative ways to reduce the hit to their pockets of a poor performing pound.”

More: Updated: Trade urges Boris to avoid a no-deal Brexit

Comment: What might Boris mean for Brexit?

No deal Brexit still ‘unlikely’ GTMC told

Green, who set up deVere Vault as a global currency app and multi-currency prepaid card in the wake of the 2016 referendum on leaving the European Union, added: “For the fourth consecutive summer, millions of British holidaymakers are finding their spending power is negatively impacted by the beleaguered, Brexit-battered pound.

“The pound has been fallen against the euro every year since the referendum – it is now worth around 15% less than before the vote.

“Sterling continues to flounder since the record-breaking slide versus the single currency began in early May, hitting a two-year low on Monday.

“It’s not just those visiting the eurozone who are in for a shock either.

“Overall, the pound is the worst-performing major currency in the last three months, meaning almost every destination is now more expensive than it was for Brits.”

Laura Lambie, senior investment director for Investec Wealth & Investment, warned that the pound could fall further if the UK crashed out of the EU without a deal.

She told the BBC: “I do think that investors are looking at a no-deal as a risk, not a certainty.

“That does mean that if we do come out of the EU without a deal, then sterling has further to fall.”

More: Updated: Trade urges Boris to avoid a no-deal Brexit

Comment: What might Boris mean for Brexit?

No deal Brexit still ‘unlikely’ GTMC told